defer capital gains tax uk

These are discussed below. Defer your capital gains tax for 30 years when you sell and receive cash at closing equivalent to 935 of your net sales proceeds.

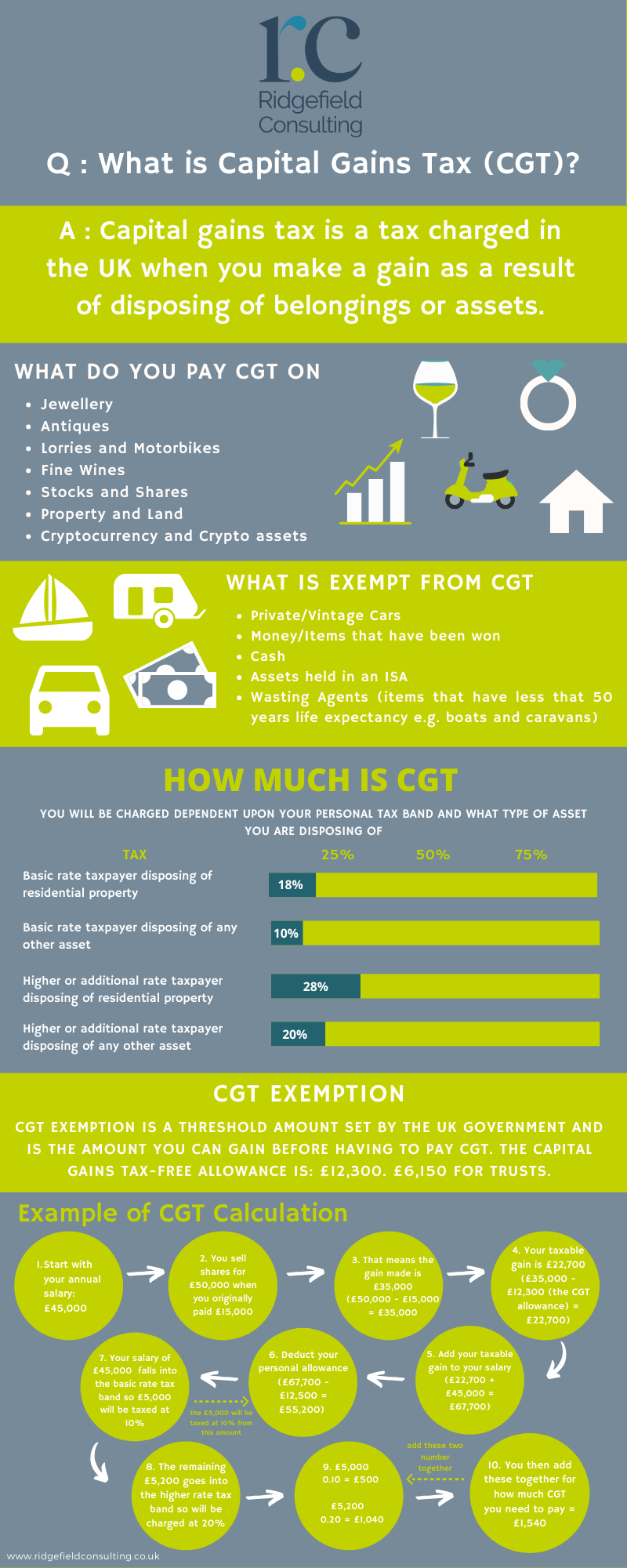

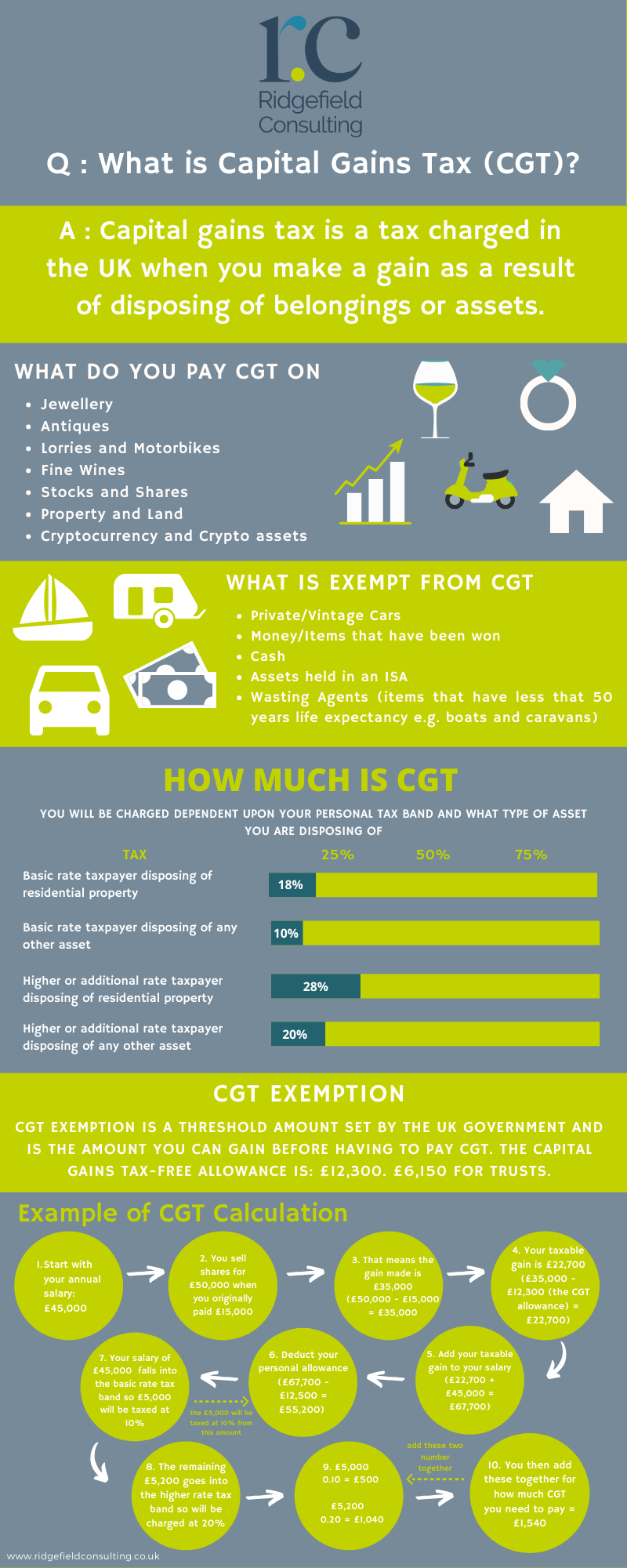

What Is Capital Gains Tax Cgt Ridgefield Consulting

Rather it is deferred into another property.

. If the gain is re-invested into a Seed EIS in the same tax year CGT relief of 50 is given. Depending on the nature of the asset disposed of this can result in the individual paying capital gains tax CGT at 20 or 28 in tax years where their taxable income and gains exceed the basic rate threshold 37700 for the 202122 and 202223 tax years but only 10 or 18 on gains in years where their net income and gains are lower than that threshold. Traditionally you would sell your asset and then have to pay the IRS 20-35 in capital gains tax.

The capital gains will eventually be taxed when that property is sold or will be deferred again in another exchange. An investor ceases to be a UK resident within three years of investment. Defer Capital Gains Tax.

A deferred gain that comes back into charge can be deferred again if its reinvested into a new EIS-qualifying investment. Up to 20 cash back A 1031 exchange is a property swap of like-kind property. It will either make sense on 31 December 2026 or on 31 December 2025.

You can defer payment of CGT by re-investing the capital gain into an Enterprise Investment Scheme EIS. As a licensed Investment Advisor Enrolled Agent Jesse Lipscomb specializes in Tax Return Based Financial Planning and believes minimizing taxes today can greatly enhance ones wealth tomorrow. ER is subject to a lifetime limit for individual investors of 10m.

Ie deferred tax is recognised when items of income and expenditure are. You defer a gain of 50000 arising in 2014 to 2015 by subscribing 50000 for EIS shares issued on 10 March 2014. QOZs are excellent for financing real estate investments by preventing capital gains tax from being due.

What this does is defer the capital gain on the original property carry over that cost basis and when the second one is sold realize the gain. This measure deals with the deferment of payment of Capital Gains Tax by certain UK resident trusts or non-UK resident individuals who trade. Capital gains tax CGT is levied on capital gains made on disposals including gifts of most assets eg.

Deferring Those Capital Gains Taxes 1 2018 eliminated personal property assets such as stamp collections art and yes your stocks from like-kind exchange treatment. If a taxpayer continues to hold their QOF investment after December 31 2026 the taxpayer needs to include the deferred gain in their 2026 tax return. In overview ER provides a lower capital gains tax rate of 10 as compared to a standard rate of 20 on gains arising when disposing of qualifying assets.

When the deferred gain comes back into charge its subject to capital gains tax at the relevant rate at that time. Deferring the property gain individuals. Deferring Capital Gains Tax on UK property disposals.

How To Defer A Real Estate Gain From Taxes. Deferred tax is the amount of tax payable or recoverable in future reporting. Defer all capital gains for eight years if the profits are reinvested and held in an Opportunity Zone.

Firstly its important to note that there is no general provision allowing CGT on a residential property to be avoided by simply reinvesting the proceeds. Meet Jesse Lipscomb Enrolled Agent. If you made a 2 million dollar profit over one-fifth of that would be paid out to the IRS because of capital gains taxes.

1 Use your CGT exemption Everyone has an annual CGT exemption which enables you make tax-free gains of up to 12300 in the 202122 tax year. Deferral of exit charge payments for Capital Gains Tax. Capital gains refers to the overall profit you made on your asset.

Antiques by individuals at two rates namely 18 andor 28. Some countries such as Spain have a form of deferral relief where a main residence is sold and the proceeds are reinvested in more qualifying property. Periods as a result of transactions or events recognised in current or previous.

The tax on those capital gains is deferred until the end of. Defer Capital Gains Period Extended to 2026 But Not Beyond The gain income is deferred until the the investment in the QOF is sold or December 31 2026. The good news is there remain ways to reduce capital taxes or even to eliminate them altogether.

Here are some ways to potentially reduce your capital gains tax liability. 28 QOF investments may be sold or exchanged or they may also be canceled. There are various capital gains tax reliefs which an individual can utilise to defer the capital gain on a property disposal until a later time thereby postponing the tax bill.

Capital gains tax is based on the combination of capital gain and earned income to determine the tax rate. This means only capital gains from the sale of real estate for investment or business purposes are eligible for this tax-deferral strategy. These arrangements are also known as 1031 exchanges in reference to.

A graduate of the United States Military Academy at West Point Jesse developed a strategy called Financial. There is also 30 Income Tax relief on the investment. Decrease the amount of any capital gains tax by 10 and 15 if the investment is held for five and seven years respectively.

If you sell all the EIS shares in March 2019 the whole of the deferred gain of. Generally FRS 102 adopts a timing difference approach. For realized but untaxed capital gains short- or long-term from the stock sale.

The deferred sales trust is a tax deferral strategy that can help owners avoid paying capital gains. Section 121 Primary Residence Exclusion Section 453 Installment Sale Section 1031 Like Kind Exchange Neve Powered by WordPress. Tax-Deferred Exchange Many people refer to this arrangement as a tax-free exchange but capital gains are not actually tax-free.

Malcolm Finney explains when and how capital gains tax can be deferred on gifts of assets standing at a gain.

.png)

What Is Cgt Deferral Relief Rlc Ventures

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

What Is Capital Gains Tax Cgt Ridgefield Consulting

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

Capital Gains Tax Cgt Holdover Relief Trusts Mercer Hole

3 Ways To Defer Capital Gains Tax That Could Turn You A Profit

If I Sell A Buy To Let Property And Buy Another Can I Defer Cgt Buying To Let The Guardian

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

Simple Ways To Avoid Capital Gains Tax On Shares The Motley Fool Uk

Capital Gains Tax Examples Low Incomes Tax Reform Group

6 Ways To Minimise Cgt On Cryptocurrency Uk Cryptocurrency Accountant And Tax Advisers Cryptocurrency Tax Specialist

Uk Capital Gains Tax For British Expats And People Living In The Uk Experts For Expats

How To Defer Capital Gains Tax Or Avoid It Altogether Wealth And Tax Management

How To Avoid Or Cut Capital Gains Tax By Using Your Tax Free Allowance Getting An Isa And More Lovemoney Com

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021