maryland earned income tax credit 2020

Applying the Act to taxable years beginning after December 31 2019. For income between 10540 and 19330 the tax credit is a constant plateau at 3584.

Earned Income Tax Credit Eitc Interactive And Resources

Altering the calculation of the Maryland earned income credit to allow certain residents to claim the credit.

. Get the most out of your income tax refund. Earned Income Tax Credit EITC Rates. 19 rows Form used by individual taxpayers to request certification of Maryland income tax filing for the purpose of obtaining a Maryland drivers license ID card or moped operators permit from the MVA.

Expansion of the Earned Income Credit SB218 was enacted under Article II Section 17b of the Maryland Constitution. Form to request a stop payment on refund check and issue a. The EITC can be as much as 6660 for a family with qualifying children.

Generally if your 2019 or 2020 income W-2 income wages andor net earnings from self-employment etc was less than 56844 you might qualify for the Earned Income Tax Credit. HB 679 increases access to the Maryland Earned Income Tax Credit for workers who dont have children and non-custodial parents who arent claiming dependents on their taxes. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit.

2021 EARNED INCOME CREDIT EIC Tax-General Article 10-913 requires an employer to provide on or before December 31 2021 electronic or written notice to an employee who may be eligible for the federal and Maryland EITC. Allowing certain taxpayers with federal adjusted gross income for the taxable year that is 6000 or less to claim a credit against the State income tax for each qualified child in an amount equal to 500. If you are a part-year resident or a member of the military.

Expanding the eligibility of the Maryland earned income tax credit to allow certain individuals without qualifying children to claim the credit. First Reading Budget and. On this step you will be asked about how you plan to file your taxes.

Ad Get Help maximize your income tax credit so you keep more of your hard earned money. Answer some questions to see if you qualify. Earned income includes wages salaries tips professional fees and other compensation received for personal services you performed.

The bills purpose is to expand the numbers of taxpayers to whom the Earned Income Credit EIC is available and to provide for a new Maryland Child Tax Credit. The Comptroller began accepting tax year 2020 returns for processing prior to the enactment of SB218. FEBRUARY 26 2020 Expanding Marylands Earned Income Tax Credit Will Benefit Families and the Economy Position Statement Supporting Senate Bill 619 Given before the Senate Budget and Taxation Committee The Earned Income Tax Credit is a commonsense tax break that helps people who work but.

For wages and other income earned in. About 86000 people in Maryland file tax returns without using a Social Security number and. HB 679 would increase the.

Your employees may be entitled to claim an EITC on their 2020 federal and Maryland resident income tax returns if both their federal adjusted gross income and their earned income is less than the following. The Maryland earned income tax credit EITC will either reduce or eliminate the amount of the state and. Providing that the amount of the credit that may be claimed by certain individuals is adjusted for inflation each year.

Earned Income Tax Credit EITC Assistant. If you are claiming a federal earned income credit EIC enter the earned income you used to calculate your federal EIC. 2020 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked.

28 of federal EITC. Expanding the eligibility of the Maryland earned income tax credit to allow certain individuals without qualifying children to claim the credit. The Maryland earned income tax credit EITC will either reduce or eliminate the amount of the state and local income tax that you owe.

The Earned Income Tax Credit EITC was first enacted on a temporary basis in 1975 as a modest tax credit that provided financial. See Marylands EITC information page. It also includes any amount received as a scholarship that you included in your federal.

And applying the Act to taxable years beginning after December 31 2019. The state EITC reduces the amount of Maryland tax you owe. The earned income tax credit is praised by both parties for lifting people out of poverty.

If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. Marylanders who made 57000 or less in 2020 may qualify for both the federal and state Earned Income Tax Credits as well as free tax preparation by the CASH Campaign of Maryland. 50 of federal EITC 1.

Allowing certain taxpayers to claim a refund in the amount of any excess. Thelocal EITC reduces the amount of county tax you owe. The RELIEF Act also enhances the Earned Income Tax Credit for these same 400000 Marylanders by an estimated 478 million over the next three tax years.

Allowing certain individuals to claim a refund of the credit. 50954 56844 married filing jointly with three or more qualifying children. Currently the credit is capped at adjusted gross income of 15570 for people without children.

Taxpayers without a qualifying child may claim 100 of the federal earned income credit or 530 whichever is less. Altering the calculation of the Maryland earned income tax credit to allow certain individuals without qualifying children to claim an increased credit. Remember on your 2020 Return you can use the 2019 or 2020 income to determine your EITC.

And applying the Act to taxable years beginning after December 31 2019. Providing that the amount of the credit that may be claimed by certain individuals is adjusted for inflation each year. MORE SUPPORT FOR UNEMPLOYED MARYLANDERS The RELIEF Act will repeal all state and local income taxes on unemployment benefits for tax years 2020 and 2021 helping people get more refunds during tax filing season.

The Earned Income Tax Credit EITC helps low-to-moderate income workers and families get a tax break. The bills purpose is to expand the numbers of taxpayers to whom the Earned Income Credit EIC is available and to provide for a new Maryland Child Tax Credit. Thestate EITCreducesthe amount of Maryland tax you owe.

In May 2018 Maryland passed legislation to eliminate the minimum. Some taxpayers may even qualify for a refundable Maryland EITC. Most taxpayers who are eligible and file for a federal EITC can receive the Maryland.

The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. Qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return. The Earned Income Tax Credit EITC helps low-to-moderate income workers and families get a tax break.

2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. The maximum credit for the 2020 tax year is 6660 and the maximum income to qualify for any credit is 56844. The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income.

Detailed EITC guidance for Tax Year 2021 including annual income thresholds can be found here. See Worksheet 18A1 to calculate any refundable earned income tax credit. Claiming the credits can reduce the tax owed and may also result in a larger refund.

If your permanent home is or was in Maryland OR your permanent home is outside of Maryland but you maintained a place to live in.

Eic Frequently Asked Questions Eic

Summary Of Eitc Letters Notices H R Block

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

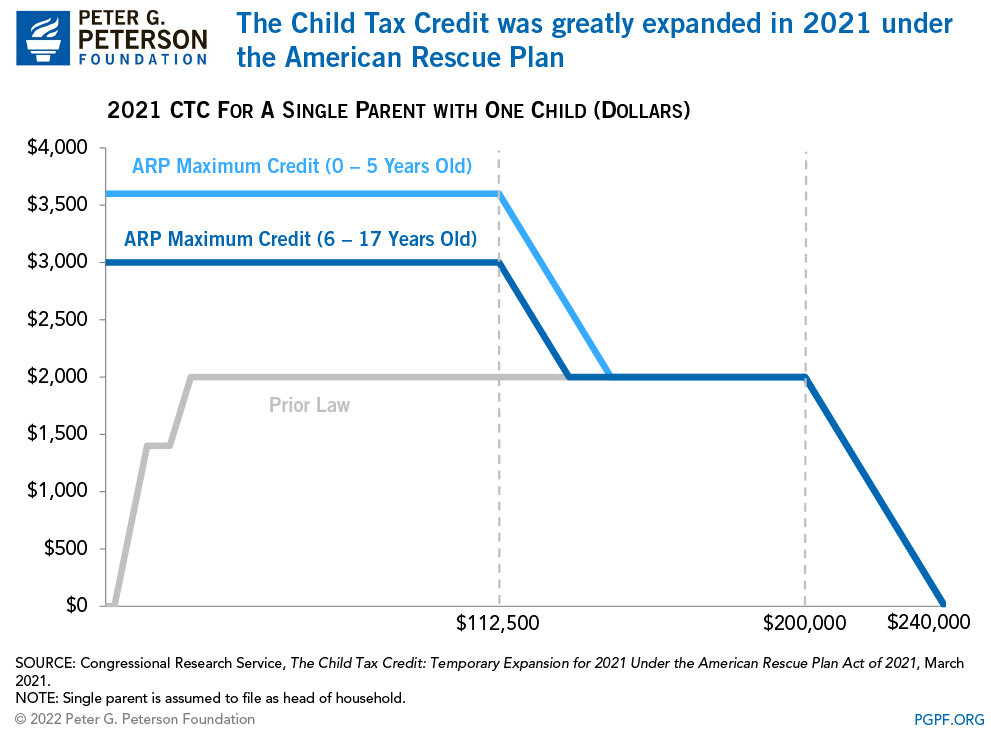

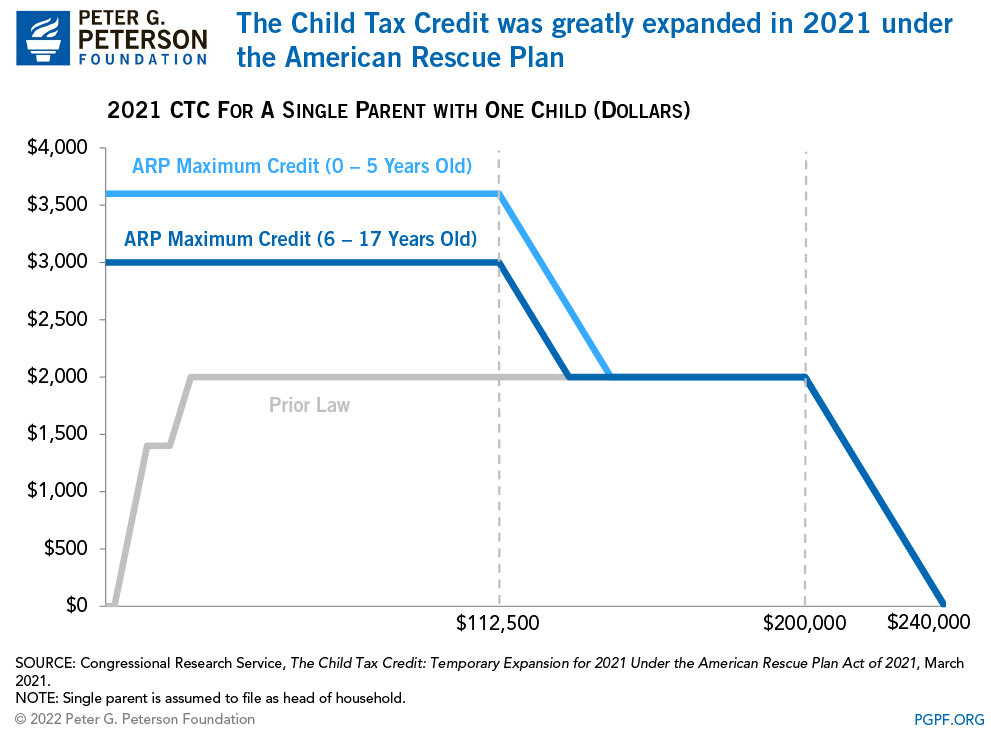

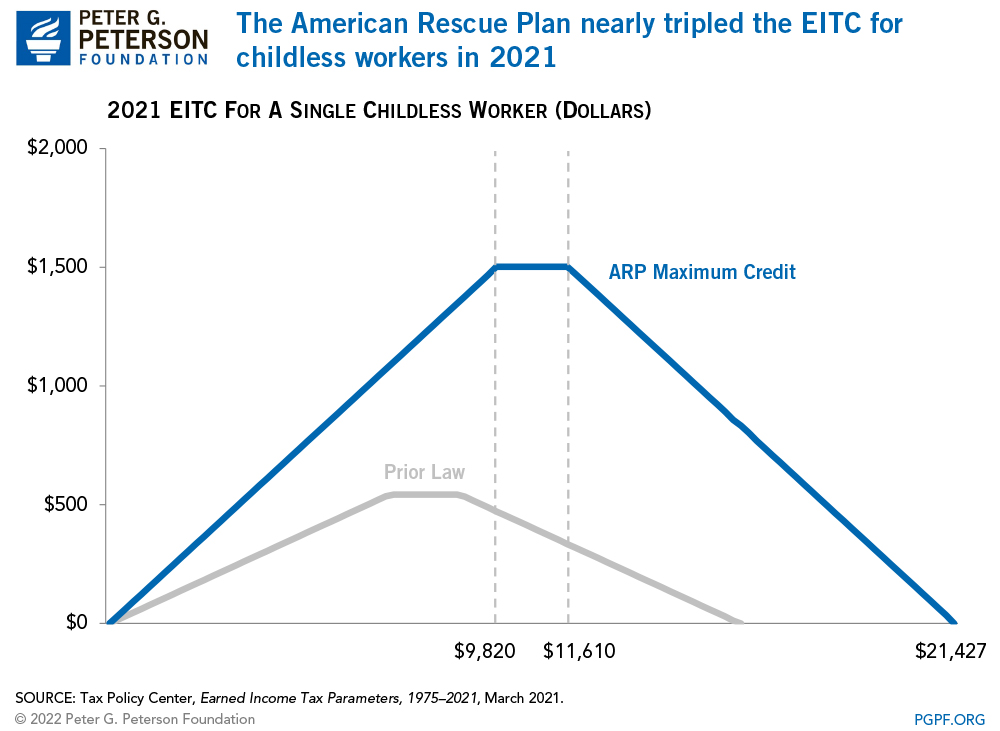

What Are The Costs Of Permanently Expanding The Ctc And The Eitc

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

What Are The Costs Of Permanently Expanding The Ctc And The Eitc

What Are Marriage Penalties And Bonuses Tax Policy Center

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

How Do State Earned Income Tax Credits Work Tax Policy Center

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

Earned Income Tax Credit Eitc Tax Credit Amounts Limits

Earned Income Credit H R Block

Earned Income Tax Credit Now Available To Seniors Without Dependents

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive